It started with a Mason jar and pocket change that drove me to the border of insanity.

I know you can relate—at least to an extent. You use cash once and end up with a small mound of change in your cup holder, pocket, or wallet that weighs you down until you finally call it quits and throw the change into the nearest container.

Finally, out of sight, out of mind.

After some time of continuously throwing leftover change into our trusty Mason jar early in our marriage, I began calling it our “honeymoon fund” for the next big trip (though my $3 in change was very unlikely to get us anywhere).

Not shortly after, I came across a yearly savings plan on Pinterest that would result in $1,000 at the end of the year by simply setting aside an increasing amount of dollars per week. 52 weeks of constant saving that would amount to $1,000 for us to do as we pleased? I was all ears.

I immediately saved the pin, shared it with Gabe, and there began our official savings account for yearly “honeymoon trips” around our wedding anniversary. It’s been seven years now since we started this fund and it has absolutely changed the way we plan for travel. With a new year around the corner, I thought this would be a fun thing to share as you plan out your budget for the new year.

So how do we do it?

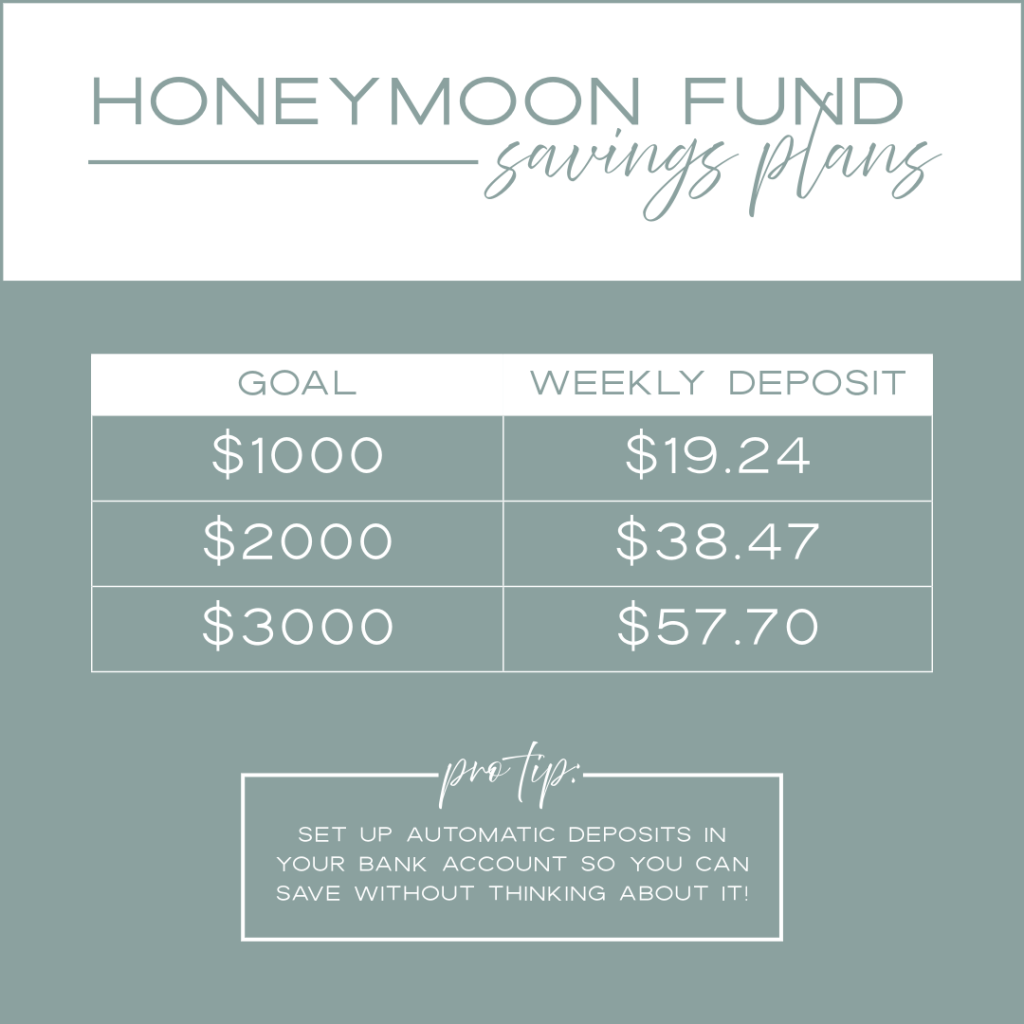

By setting up an additional savings account, we simplified the Pinterest method and started automatically depositing $19.24 per week the first week of January 2017 to get us to the final $1,000 for a trip in 2018. I’ve provided a cheat sheet here to get you started. And this doesn’t have to be for “honeymoon” trips either! This savings account can be for personal vacations, a big item you want to save up for, etc. Use it as you see fit!

Now, I married a man who was a travel agent in a past life, so we like to challenge ourselves to stretch our dollar and have our honeymoon fund cover the cost of hotel, airfare, and some (if not all) activities. When it comes to food, we save an additional, separate amount closer to the trip.

What does this mean?

This means we don’t always book our honeymoon trip around our wedding anniversary and choose to travel in the off-season like February or even October. This also means early morning flights and booking with travel discounts through Hotwire or our personal favorite, Costco Travel.

By being intentional to not touch this weekly deposit, we’ve reaped the benefits yearly and, in some years, have even increased the weekly amount to $57.70 per week for a savings of $3,000 to go towards the next year’s trip when we knew we wanted to go international.

So far we’ve gone to (all thanks to our honeymoon fund)…

- 2018: San Diego, California

- 2019: New York City, New York

- 2020: Isle of Palms, South Carolina + Denver, Colorado

- 2021: Oahu, Hawaii

- 2022: London, England

- 2023: San Juan, Puerto Rico

- 2024: Venice + Rome, Italy

I can’t help myself, so allow me a brief moment for a small selection from some of these trips!

My favorite part of this savings account is that it gives us the freedom to plan a trip in advance without having to think twice about it. It also gives us an excuse to get away together and I will never, ever turn that down.

With the ebbs and flows of life, this also gives us the freedom to adjust the weekly deposit to whatever works best with our budget for the next year. So even though we saved $3,000 in 2023 for this year’s trip, we downsized for next year’s to $1,000 since I left my job back in February and we weren’t sure what life was going to look like from a purely financial perspective.

Take it from us and get those weekly deposits scheduled the first week of January 2025! You’ll be so glad you did when you’re on a beach sipping away on your drink of choice in 2026.

See you next week!

Leave a comment